SAVANNAH, Ga. (WSAV) – Student loan borrowers from Savannah State University (SSU) are uncertain about their future after graduation due to yearly rising costs.

“I think I only know one person not struggling with loans,” said Saria Smith, a recent graduate from SSU, a Historically Black College or University. “We as young people aren’t really taught about how student loans are going to affect us later in life.”

With over $20,000 in public student loans, Smith plans to go to graduate school to get a Ph.D. and a law degree. Like many students, Smith applied for federal loans when she was 17 years old after being encouraged to by her institution.

Taking out a loan is a necessary evil for many students to get a higher education and land a high-paying job. America has a total of $1.75 trillion in private and public student loan debt with Georgia’s average student loan debt at $40,268.87, according to Forbes.

“If I didn’t take out these loans I would not have been able to go to Savannah State, and that’s not an experience I’d be willing to give up,” said Smith.

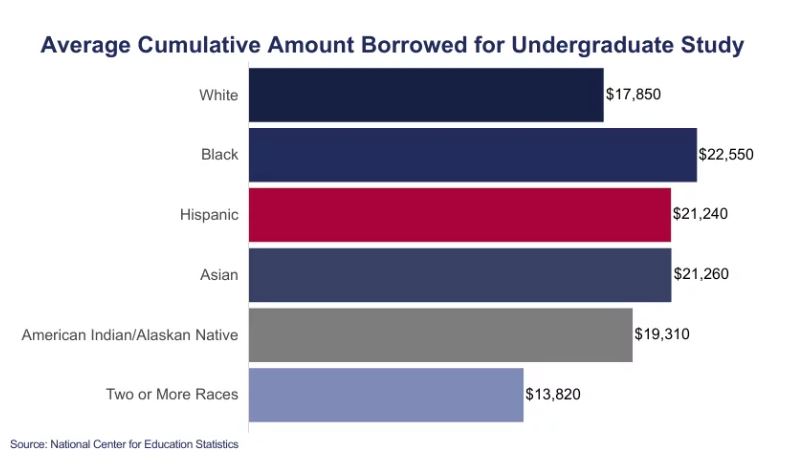

According to the Education Data Initiative, the demographics of student loan borrowers show that Black students owe 188% more than white students. The study also mentioned that white college graduates have seven times the wealth of Black graduates.

“All I knew was that if I wanted to go to college, I had to get scholarships or loans,” Smith said, “and the scholarships weren’t coming through, so the loans were the only option.”

One out of eight students receive scholarships despite there being around 1.5 million available. Also, 7% of college students are able to pay 90% of their tuition with their scholarships.

“We are trying to support an economy that does not support us,” said Smith. “Seeing how the people who don’t want us to have debt relief also took out PPP loans during COVID — that is ridiculous.”

Smith refers to the over $757.1 billion in forgiven Paycheck Protection Program, PPP, loans taken out by private businesses.

“I just don’t understand how you (private business) can have $2 billion worth of loans forgiven for things you don’t need, but my $20,000 just to start my career not forgiven is ridiculous,” said Smith.

Looming loan payments also haunt undergraduate students like Kerri Washington, a rising junior at SSU, which contributes to her stress on top of balancing her classes and work schedule.

“It’s like a weight on my shoulders, and it’s always in the back of my mind,” said Washington. “People shouldn’t have to pay loans. They shouldn’t have to pay to go to college to get an education.”

Washington was also 17 when she applied for student loans and owes around $20,000. She wished she knew the impact that this would have on her mental health and future, but like many students, she knew that without them she would not be able to go to college.

Washington enrolled in online classes to balance her work and school life, working full-time at a day care clocking in at 6 a.m., going to campus for two hours and then back to work. She plans to find a second job to pay for groceries, rent and gas.

College tuition fees, room and board have risen exponentially on average for all four-year institutions over the past 40 years:

- 1980-81: $10,630

- 1990-91: $14,937

- 2000-01: $19,422

- 2010-11: $26,274

- 2020-21: $29,033

“I don’t know how students do it nowadays because tuition rose but the quality of teaching fell,” said Donna Reed, a 69-year-old retired teacher of 30 years and SSU class of ‘77 alumni. “It was extremely hard for me paying for college, but the tuition now is 10 times more.”

Reed did not have student loans but struggled to pay tuition when she attended SSU, going to her classes in the morning and working as a telephone operator until the morning to repeat the cycle again. She credits her professors for being there to always help.

She notes that quality changed due to a lack of funding for HBCUs.

“I would like to see USG (University System of Georgia) funding for more HBCUs,” said Smith. “We have incredible people coming out of our school and we don’t have much access for students to thrive.”

According to data from the 2019 fiscal year, public HBCUs received on average $29,469,647 endowment while public non-HCBUs received $361,991,303. In 2021, the $45 billion proposed in the spending plan by President Joe Biden to go to HCBUs was later revised to $2 billion.

“I feel that the people who are in power now, especially the people who are making these decisions, do not work in the interest of the people,” said Smith. “They only work in the interest of those who are funding them and that is completely against American values.”

Student loan payments will be due starting on Oct. 1 after the Supreme Court ruled in a 6-3 vote to reject Biden’s loan forgiveness program to forgive $20,000 for Pell Grant recipients and $10,000 for other loan holders.

To counteract the court’s decision, the Biden Administration is working on an initiative to lower monthly debt payments with the Saving on a Valuable Education (SAVE) plan. This plan aims to cut monthly payments by half to ensure borrowers avoid unpaid interest.